As your trusted accounting partner, we want to bring your attention to the ATO’s recent release of crucial draft guidance: Draft Taxation Ruling (TR) 2025/D1 and accompanying Practical Compliance Guidelines (PCG 2025/D6 and PCG 2025/D7).

These documents clarify how the ATO will approach the deductibility of expenses for individuals renting out property, with a sharp focus on properties that are also used as holiday homes (or part of a family residence). If you own a beach house, a ski chalet, or rent out a room in your primary residence, these proposed rules demand immediate review of your current arrangements.

Step 1: Is Your Rental Property a “Holiday Home”?

The first step under the new guidance is determining if your rental property meets the definition of a “holiday home”. A ‘holiday home’ is defined as a property used (or held for use) for your holidays or recreation, or for the holidays or recreation of your family members and friends, especially if they use it for no rent or a reduced rate.

This determination relies on an objective analysis of the pattern of how the property is used or held for use over time.

Step 2: The Critical Barrier: Section 26-50 and the “Mainly” Test

If your property is categorised as a holiday home, the rules under Section 26-50 of the Income Tax Assessment Act 1997 apply, treating it as a leisure facility.

The core consequence of Section 26-50 is that deductions for many losses or outgoings relating to ownership or use of the holiday home are denied entirely.

These non-deductible ownership expenses commonly include:

-

- Interest on borrowings (mortgage interest).

- Council rates.

- Land tax.

- Repairs and maintenance (in some cases).

These expenses are denied unless your holiday home meets a key exception: it must be used (or held for use) mainly to produce assessable income in the nature of rents, lease premiums, licence fees, or similar charges, at all times during the income year.

The Danger Zone: Why Personal Use During Peak Season is Critical

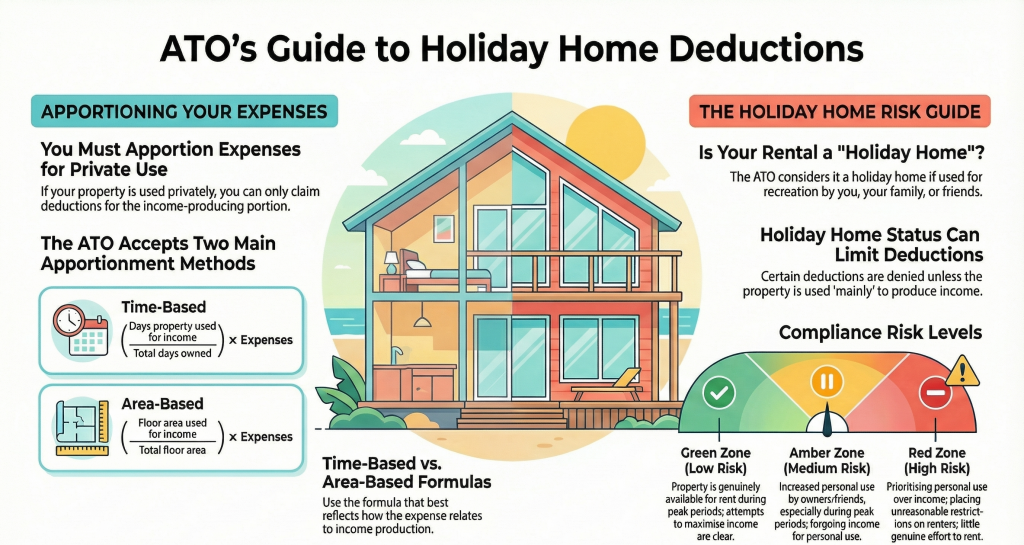

The ATO emphasises that determining if a property is used “mainly” to produce income is a question of fact and degree, requiring consideration of the degree, extent, and prioritisation of uses. A simple calculation based only on the number of days rented is inadequate.

A critical factor is the extent to which your holiday home is actually available or used as a rental at a time when use of such a property is desirable for holiday pursuits (e.g., school holidays, public holidays, or peak seasonal demand periods).

If you reserve the property for personal use during these peak periods, the ATO guidance suggests this indicates the property is not mainly held for income production throughout the year.

The draft PCG 2025/D7 categorizes arrangements into risk zones:

-

- Red Zone (High Risk): This applies if you are prioritizing personal use, particularly by blocking out times for personal use during periods of high rental demand. If your arrangement falls into the Red Zone, the ATO will highly scrutinize your claims, and the ownership deductions (rates, interest, etc.) are likely to be denied outright.|

For example, if Daniel and Kate owned a beach house that they blocked out for school holidays for personal use, the house was considered a holiday home and was not mainly used to produce rental income, preventing them from claiming ownership deductions.

- Red Zone (High Risk): This applies if you are prioritizing personal use, particularly by blocking out times for personal use during periods of high rental demand. If your arrangement falls into the Red Zone, the ATO will highly scrutinize your claims, and the ownership deductions (rates, interest, etc.) are likely to be denied outright.|

Step 3: Apportionment: What if I Pass the “Mainly” Test?

For now, the ATO’s position remains cautious, but the potential for renters to claim a percentage of their actual occupancy costs (like rent) is real, provided the space is genuinely set aside as a dedicated office.

If your property passes the “mainly to produce assessable income” test (or if the expenses you incurred are not related to ownership, such as agent fees or cleaning costs), you must still apportion your expenses to reflect the extent they were incurred in producing income.

Deductions must be apportioned on a fair and reasonable basis. The draft PCG 2025/D6 outlines several acceptable methods for apportionment:

-

- Time-based Method: Deductions are calculated using the ratio of days the property was used to produce income compared to the total days you owned the property during the year.

- Area-based Method: Used when only part of a property is rented.

- Combined Area and Time-based Methods: Used when both the area and time of use vary.

It is essential to keep detailed records to support the chosen apportionment method and to differentiate between income-producing and non-income-producing use.

Transitional Relief and Action Items

The Commissioner recognises that the application of Section 26-50 to rental properties may be new to many taxpayers. Therefore, the ATO has offered a transitional compliance approach.

The ATO will not dedicate compliance resources to reviewing whether Section 26-50 applies to expenses incurred in relation to holiday homes that are rental properties before 1 July 2026, provided those expenses were incurred under an arrangement entered into prior to 12 November 2025.

Key Takeaways and Actions for Clients:

-

- Review Peak Period Use: If you prioritise personal use during high-demand seasons (like summer or school holidays), your property is at high risk of failing the “mainly to produce assessable income” test, leading to the potential denial of all ownership deductions (interest, rates).

- Document Everything: Maintain meticulous records documenting the availability of your property for rent, rental rates, and all instances of private use.

- Apportion Correctly: If you can claim deductions, ensure you use a fair and reasonable method (time, area, or combined) to exclude private/domestic use.